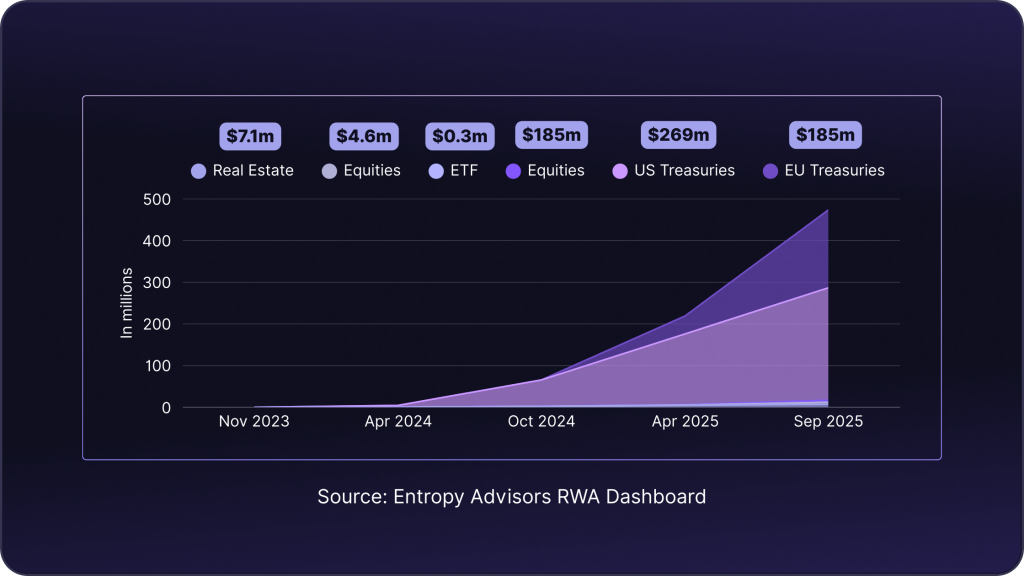

Arbitrum crosses $450m in real-world asset TVL

Arbitrum has reached a new milestone in the growth of tokenized finance. Data from Entropy Advisors on Dune shows that more than $450 million worth of real-world assets (RWAs) are now locked on the network. This figure highlights how quickly traditional financial products are being adopted onchain, turning Arbitrum into one of the leading ecosystems for tokenization.

The rise of RWAs on Arbitrum reflects a wider shift in how investors look for yield and stability. Treasuries, real estate, equities, and other familiar assets are no longer limited to banks or brokerage accounts. They are now available onchain, accessible through a wallet, and tradable at any time. For many, this means access to income and diversification that was once out of reach.

What makes this growth significant is not only the headline number, but the pace at which it has scaled. In less than two years, RWAs on Arbitrum have moved from an early experiment into a serious category with hundreds of millions in value. The composition of these assets also shows a balanced spread between safe yield products and growth-oriented sectors like real estate.

The breakdown of $466.9 million in RWA TVL

As of September 22, 2025, tokenized RWAs on Arbitrum totaled $466.9 million. The split looks like this:

- US Treasuries: $269.3m

- EU Treasuries: $185.6m

- Real Estate: $7.1m

- Equities: $4.6m

- ETFs: $0.3m

Treasuries dominate, accounting for the majority of inflows, as investors seek onchain exposure to safe and predictable returns. Real estate is emerging as a strong niche, powered by platforms that specialize in rental properties and income-producing assets. Equities and ETFs are smaller for now but show early signs of traction. Together, they demonstrate how Arbitrum has become a home for a wide spectrum of tokenized finance.

The assets and companies driving RWA growth on Arbitrum

Treasuries on Arbitrum

US Treasuries and EU Treasuries are the largest share of RWA value on Arbitrum, together making up more than $450 million. These tokenized bonds provide investors with stable returns that mirror traditional fixed income markets but settle onchain. Platforms issuing these assets have found strong demand from both institutions and individuals who want yield that feels safe yet accessible through crypto rails.

Real Estate on Arbitrum

Real estate is one of the fastest-emerging categories, with $7.1 million already tokenized on Arbitrum. Platforms like Estate Protocol are leading here, bringing high-quality residential properties and Airbnbs directly onchain. Investors can purchase fractional ownership for as little as $250 and begin earning monthly rental income in stablecoins like USDC. Properties are fully managed, with verified operating histories, so buyers are not speculating on empty listings but owning pieces of real, income-generating homes.

Equities and ETFs on Arbitrum

While smaller in total size today, equities and ETFs are beginning to appear on Arbitrum. These assets allow investors to get exposure to public markets while staying onchain. It is early, but the presence of tokenized stocks and funds shows how wide the scope of tokenization can become. If adoption follows the path of Treasuries, this could become one of the fastest-growing categories in the years ahead.

Companies driving the growth of RWAs on Arbitrum

Robinhood: Trade, invest and earn on Arbitrum via Robinhood.

Estate Protocol: Invest in luxury real estate on Arbitrum.

Centrifuge: The leading platform for tokenized financial products.

OpenEden: Get access to onchain US Treasury yields.

Spiko: Future of capital markets infrastructure, beginning with money markets.

Theo: Use your assets across different chains and protocols seamlessly and efficiently.

Dinari: Buy 1:1 backed Real World Asset tokens of stocks, ETFs, bonds, REITs, and other assets.

What this growth means for RWAs in general

The jump to over $450 million in tokenized assets on arbitrum is not just a milestone for one network. It signals that real-world assets are moving past the stage of small pilots and experiments. The numbers now show real adoption, with institutional names and crypto-native teams all active side by side.

Treasuries crossing hundreds of millions onchain prove that investors want safe, yield-bearing products that settle faster and more transparently than in traditional systems. real estate listings show that even high-barrier assets can be opened up to a global pool of investors. Equities and ETFs highlight that public markets can eventually become as easy to access as swapping tokens.

Each category reinforces the same story that RWA is no longer a fringe idea. It is becoming a foundational layer of defi. Arbitrum is showing how a chain can scale to hold billions in assets that were once locked away in old structures. The growth here suggests that RWAs will be one of the main drivers pulling traditional finance into web3.

Outlook for RWAs on Arbitrum

The rise to nearly half a billion dollars in RWA TVL is likely only the beginning. treasuries and money market funds have proven the model at scale, and now other categories are starting to follow. as more platforms bring Treasuries, Real Estate, Equities and ETFs onchain, Arbitrum could soon host billions in assets that previously lived only in traditional finance.

For investors, this growth means more choices and lower barriers. a person who once needed hundreds of thousands to access prime Real Estate can now start with a fraction of that on Arbitrum via Estate Protocol. It’s the future of onchain income. For institutions, the network shows that onchain rails can handle real-world value securely and transparently.

If current trends hold, RWAs on Arbitrum could become one of the strongest pillars of DeFi in the next cycle. Arbitrum is positioning itself as the network where this convergence happens, where traditional yield and digital liquidity meet.

Insights powered by Entropy Advisors

Data for this article is sourced from the Arbitrum RWA Dashboard on Dune, created by Entropy Advisors. Entropy Advisors is a research and analytics firm that closely tracks real-world asset adoption across blockchains. Their dashboards and insights are widely used in the crypto industry to monitor growth trends, tokenization data, and capital flows. By compiling onchain evidence, they provide transparent reporting on categories like treasuries, equities, ETFs, and real estate. This makes their work a trusted reference point for anyone following the expansion of RWAs on Arbitrum.