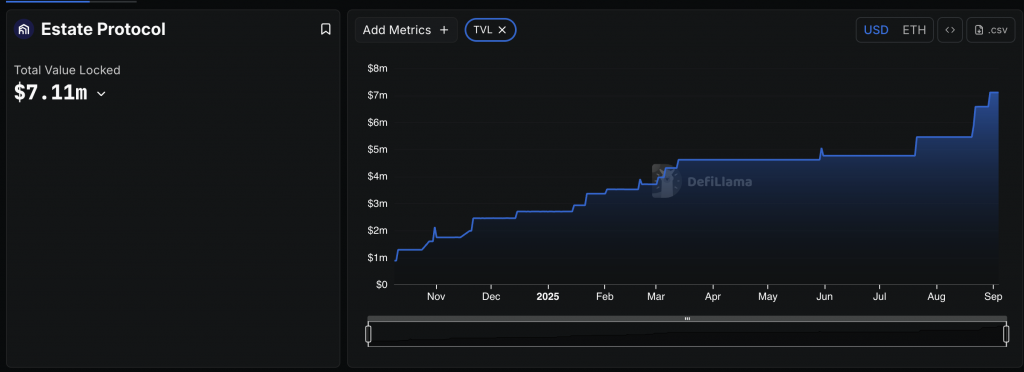

Estate Protocol has crossed $7 million in institutional grade real estate brought onchain on Arbitrum.

That means real homes. In real locations. Owned by people around the world. These aren’t just numbers on a dashboard. These are places that pay rent every month. And that rent goes straight to the wallets of people who started with just two hundred and fifty dollars.

For years, real estate was only for people who had a lot of money and time. Now it’s available to anyone with a phone and a wallet. We’re changing who gets to own what.

Last month, we crossed the seven million mark in total tokenized real estate. That includes short-term rentals, premium homes, and stable properties across the US. All of them fully documented, legally backed, and earning income.

View on DefiLlama – https://defillama.com/protocol/estate-protocol

What makes up the $7 million

The $7 million milestone reflects real properties with real income potential. These are fully documented assets, vetted for quality, and held under a trust structure that gives investors legal rights and not just a token on a screen.

Each listing brought onchain through Estate Protocol follows a strict process:

- Verified property documents

- Revenue and rental history (where applicable)

- Market-based yield estimates

- Regulatory compliance with UK-based trust structure

- Full onchain record of ownership, transactions, and rent payouts

Types of Properties Listed

The current $7 million covers a mix of:

- Short-term rental homes (Airbnb-type) in high-demand US cities, like Austin and Glendale

- Premium residential homes in stable suburban neighborhoods, such as the recently sold-out Richmond property

Some of these properties offer annual rental yields as high as 15 percent, depending on location, demand, and occupancy. The income is paid monthly in USDC, visible onchain, and split fairly among all token holders.

Why tokenized real estate is different

Access

You do not need to save for years to buy a whole house. You can start with 250 dollars and own a fraction that pays rent.

Ownership

You are not buying exposure to a fund. You are buying a legal claim to the property through a trust structure.

Income

Rent is paid in USDC each month. It goes to your wallet and you can see every payout.

Liquidity

Traditional property can take months to sell. Tokens can be sold onchain whenever there is a buyer.

Transparency

All key documents, ownership records, and transactions are visible onchain. No hidden line items or surprise fees.

Costs and middlemen

There are fewer layers between the tenant and you. That reduces friction and helps more of the income reach the holder.

Time

Buying a share takes minutes with a wallet. No bank visits. No paper trail.

Borders

Anyone with a wallet can participate. You are not limited by your country’s property prices.

Platform choice

Estate Protocol runs on Arbitrum for low fees and fast settlement while benefiting from Ethereum’s security.

What this means for an investor

You can build a simple habit. Add 250 dollars when you can, grow a basket of properties across cities, and let the rent stack month by month. No tenants to manage. No renovations to fund. Just real assets that pay you on time.

From waiting to owning today

For decades the idea of real estate was linked with patience. You worked a job, saved what you could, and maybe one day you bought a home. That path left most people out. By the time they reached it, the market had already moved ahead.

Tokenized real estate changes that story. You do not have to wait years. You can begin earning rent today with a small share of a property. It gives people the chance to step into ownership early, instead of waiting until it feels too late.

There is also the peace of knowing your income is steady. Monthly rent in USDC comes into your wallet whether or not your salary changes or your trading works out. It is money you can count on, simple and predictable.

This sense of stability is rare in a world where jobs shift quickly and markets rise and fall overnight. For many, that rent notification means more than just dollars. It means freedom from uncertainty.

Instead of chasing wealth at the end of a long road, you can start owning it now. Each month adds up. Each property builds your base. The difference is no longer measured in decades, but in the income that arrives today.

What’s next

Reaching seven million dollars in tokenized real estate is only the beginning. The goal has always been larger than one milestone.

The focus now is to keep adding properties that bring steady income. More short term rentals in high demand cities are already in the pipeline. These are the types of homes that fill quickly and keep occupancy strong, which means more rent flowing to holders.

Expansion into new markets is also ahead. Real estate does not stop at one country, and neither should access to it. The same structure that makes a home in Austin available today can bring homes in other stable economies tomorrow.

Estate Protocol is also preparing new features. The ability to stake tokens, access lending against holdings, ability to trade tokens on DEX, and track deeper analytics will help investors manage and grow their portfolios. We will also be adding property pools for people to benefit from the real estate market without having to commit to a single property. Each step makes the platform more complete and more useful to anyone who wants passive income without barriers.

The path to ten million dollars in real estate is clear. And after that, the path to making tokenized ownership a normal way for people to build wealth.

The next chapter is about scale, access, and giving more people the stability that comes from real assets and monthly rent. Stay tuned.